Home Online Title Loans – No Store Visit & No Proof of Income

Online Title Loans – No Store Visit & No Proof of Income

Published on

Fact-Checked

Close

Each article is reviewed by our editorial team and fact-checked for accuracy using credible sources. We regularly update content to reflect current information (see last update at top of article). Learn more about our editorial standards.

How much cash can i get

Find out now. It's fast, secure & free!

When you need fast cash, driving to a physical location shouldn’t be a requirement. With online title loans with no store visit, everything from application to approval can be completed remotely. This means no waiting in line, no unnecessary travel, and no time wasted.

These loans allow you to borrow money using your vehicle’s title as collateral while continuing to drive your car. Even if your credit isn’t perfect, you may still qualify based on your car’s value and your ability to repay the loan. In many cases, funds can be deposited into your account within 24 hours.

Key Takeaways

- You can complete the entire loan process 100% online, from application to funding, without ever needing to visit a store in person.

- Approval depends mostly on your vehicle’s equity and your ability to repay the loan, not your credit score.

- Funding can be available the same day or next day if your documents are submitted and approved early.

- You may be able to borrow up to $50,000, depending on your car’s value and your state’s regulations.

- Flexible repayment terms are available, and there are no penalties for paying off your title loan early.

- Lenders often accept alternative forms of income, such as benefits or bank deposits, so a traditional paycheck isn’t always required.

What Are Online Title Loans with No Store Visit?

An online title loan is a secured loan that uses your car title as collateral. The key difference from traditional title loans is that the entire process is digital, from application to signing. That means you can complete every step from your smartphone or laptop.

Many borrowers choose this type of loan when they need quick access to funds for emergencies such as medical bills, rent, or urgent repairs. Since it’s secured by your vehicle, approval may be easier compared to unsecured loans like personal loans or credit cards.

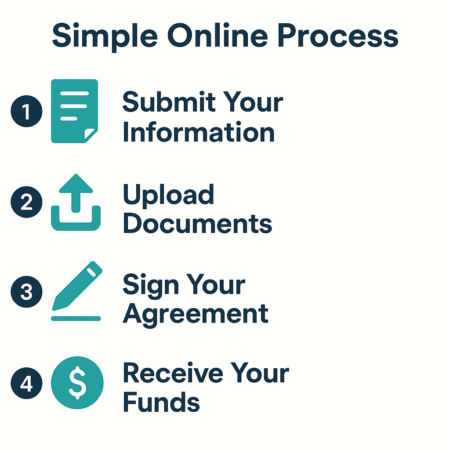

How It Works – Simple Online Process

- Submit Your Information

Fill out a quick online form with your basic personal and vehicle details. Most applicants can complete this step in just a few minutes. - Upload Required Documents

Instead of bringing your car in, you’ll upload clear photos of your vehicle, title, ID, and any other requested documents. Virtual inspections are accepted by most lenders. - Get Conditional Approval

Once your details are reviewed, you’ll receive a conditional offer that includes the loan amount, term length, and estimated APR. - Sign Your Agreement Online

Review your loan terms carefully, then sign electronically. There’s no need to visit a branch. - Receive Your Funds

If approved early in the day, funding may be available within 24 hours. Funds are usually sent via direct deposit, but alternative options may be offered.

No Credit, No Problem!

Montana Capital makes title loans online without an inspection easy, even if you don’t have a credit score. This makes funding your financial emergency simple, with minimal hoops to jump through.

What You May Need to Qualify for Title Loans?

Most lenders require just a few standard items to process your application. While it’s a simple checklist, understanding each requirement can help speed up your approval.

1. Vehicle Title in Your Name

Your vehicle title must be under your name and free of major liens. This shows that you legally own the vehicle and can use it as collateral for the loan. If your title has a small existing lien, some lenders may still work with you, but additional documentation might be required.

2. Government-Issued ID

A valid driver’s license or other government-issued ID is needed to confirm your identity. This step is required to comply with lending regulations and prevent fraud. Make sure your ID is up-to-date and clearly visible when submitting photos.

3. Proof of Residence

Lenders typically require proof of where you live, which can be a utility bill, lease agreement, or official mail with your name and address. This ensures the lender is compliant with state lending laws and can determine your eligibility based on your location.

4. Proof of Income or Alternative Income Verification

Traditional pay stubs are not the only acceptable form of income proof. Many lenders accept Social Security income, unemployment benefits, bank deposits from self-employment, or other alternative sources. The main goal is to show that you have the ability to repay the loan, not that you work a specific job.

5. Photos of Your Vehicle

Photos from multiple angles (front, back, sides, interior, and odometer) help the lender assess the vehicle’s condition and value. This is an alternative to an in-person inspection and can be submitted directly from your phone.

Emergency Title Loans – When You Need Cash Fast

Title loans can be a fast option during emergencies when time matters. They are commonly used to cover:

- Emergency medical bills

- Urgent vehicle repairs

- Rent or utility payments

- Sudden travel needs or family emergencies

Because these loans are based on your car’s value rather than credit history, funding can happen much faster than with traditional bank loans.

Typical Loan Amounts & Terms

| Vehicle Value | Loan Amount | Term Length | APR Range | Funding Speed |

| $5,000 | $2,500 | 12–36 mo | 150%–300%+ | Same day / next day |

| $15,000 | $7,500 | 12–36 mo | 150%–300%+ | Same day / next day |

| $30,000 | $15,000 | 12–36 mo | 150%–300%+ | Same day / next day |

The loan amount depends on several factors: the equity in your vehicle, state regulations, and your ability to repay the loan. While some lenders can fund larger amounts, the typical loan range is 25% to 50% of the vehicle’s value.

About APR: Title loan pricing is set by state law + lender policy. Federal and independent research finds title loan APRs commonly near 300% and sometimes higher; a few states require much lower caps, while others restrict or prohibit title loans. Always review your agreement and your state’s rules before signing.

Title Loan Fees & Calculator

While title loans can provide fast access to funds, it’s essential to understand all associated costs before signing.

Common Fees

- Origination Fee: Charged by some lenders to process the loan (varies by state).

- Lien Recording Fee: A small state or DMV fee to register the lien on your title.

- Late Payment Fee: If a payment is missed or delayed, additional fees may apply.

- Prepayment: Many lenders allow early payoff with no penalty, helping you save on interest.

Use the Title Loan Calculator

Before borrowing, you can use a Title Loan Calculator to estimate:

- Total loan amount you may qualify for

- Estimated monthly payments

- Interest costs over the life of the loan

- Potential savings from early repayment

This can help you borrow responsibly and avoid surprises.

Real-Life Experiences From Borrowers

“Fast and Simple” – Maria G., Los Angeles, CA

“I applied in the morning, uploaded my car photos, and got approved by noon. The money was in my account the next day. I liked that I didn’t have to leave home.”

“Bad Credit Didn’t Stop Me” – James T., Phoenix, AZ

“My credit wasn’t great after a tough year, but they approved me based on my truck’s value. I used the loan to cover medical bills and paid it off early without fees.”

“It Helped During an Emergency” – Vanessa L., Las Vegas, NV

“When my water heater broke unexpectedly, I didn’t have savings to cover it. This loan gave me the funds fast, and the process was straightforward.”

Benefits of Online Title Loans

- No in-person visit required – apply 100% online.

- Fast approval and funding within 24 hours.

- Keep driving your car while repaying the loan.

- Transparent terms with no hidden fees.

- Alternative income accepted.

- Flexible repayment options.

This loan type is especially useful for those who need funds urgently but prefer not to deal with traditional bank requirements or in-person visits.

Disadvantages of Title Loans

While title loans offer speed and convenience, they may not be right for everyone. It’s important to weigh the potential drawbacks:

- High Interest Rates: Even though APR is capped in some states, costs can be higher than traditional loans.

- Risk of Vehicle Repossession: If you default on the loan, the lender may repossess the vehicle.

- Short-Term Obligation: Title loans are typically designed for short-term use, not long-term financial solutions.

- Additional Fees: Late payments can add costs quickly.

- Limited Availability: Not all states allow online title loans.

Always compare options and borrow only what you can realistically repay.

States Where Online Title Loans Are Available

We offer online title loans in multiple U.S. states, depending on local lending regulations. If you live in one of the states below, you may be able to submit your loan request online and receive funds quickly.

| State | Online Title Loans Available | Funding Speed |

| California | Yes | Same day |

| Texas | Yes | Same day |

| Virginia | Yes | Next day |

| Florida | Yes | Next day |

| Georgia | Yes | Next day |

| Tennessee | Yes | Next day |

*Availability depends on state regulations. Funding times vary by application time and verification process.

FAQs About Online Title Loans

Can I Get a Title Loan With No Proof of Income?

Yes. Many lenders accept alternative income verification such as bank statements, Social Security, or benefits. Even if you don’t have a traditional paycheck, you may still qualify.

How Fast Can I Get My Money?

Funding may be available in as little as 24 hours if your documents are submitted and approved early in the day. Timing may vary depending on the lender and your location.

Do I Need Good Credit to Get Approved?

No. Title loans are primarily based on your car’s value and your ability to repay the loan, not your credit score. This makes them more accessible for borrowers with less-than-perfect credit.

Will I Lose My Car?

You can continue driving your vehicle while repaying the loan. However, if payments are missed or the loan goes into default, the lender may have the right to repossess the vehicle.

Are Title Loans Available in Every State?

No. Regulations vary by state. Check the table above to see where online title loans are offered and what rules may apply in your state.

Can I Pay Off My Loan Early?

Yes. Many lenders allow early repayment without penalties. Paying off your loan early can help reduce your total interest costs.

Can I Get Title Loans Online With Direct Deposit the Same Day?

Yes, many lenders offer title loans online with direct deposit the same day, allowing qualified borrowers to receive their funds quickly after approval. Once you complete the online application, submit your documents, and sign your loan agreement, the funds can be transferred directly into your bank account, often within hours.

Same-day direct deposit can be especially helpful during financial emergencies, since you don’t need to pick up cash or visit a physical location. Funding speed may vary depending on your bank’s processing times, the time of day you apply, and your state’s regulations.

Apply for an Online Title Loan Today

With no store visit required, you can apply from anywhere, get a quick decision, and access funds faster. Whether you’re dealing with unexpected bills or need emergency cash, online title loans offer a fast and flexible solution.

Start your online request now and see how much you may qualify for.