Home > Title Loan Calculator

Title Loan Calculator

How much cash can i get

Find out now. It's fast, secure & free!

How to use

Our Loan Calculator

Our Loan Calculator

- Fill in the loan amount

- Fil in the interest rate

- Select the loan term

(1 to 36 months)

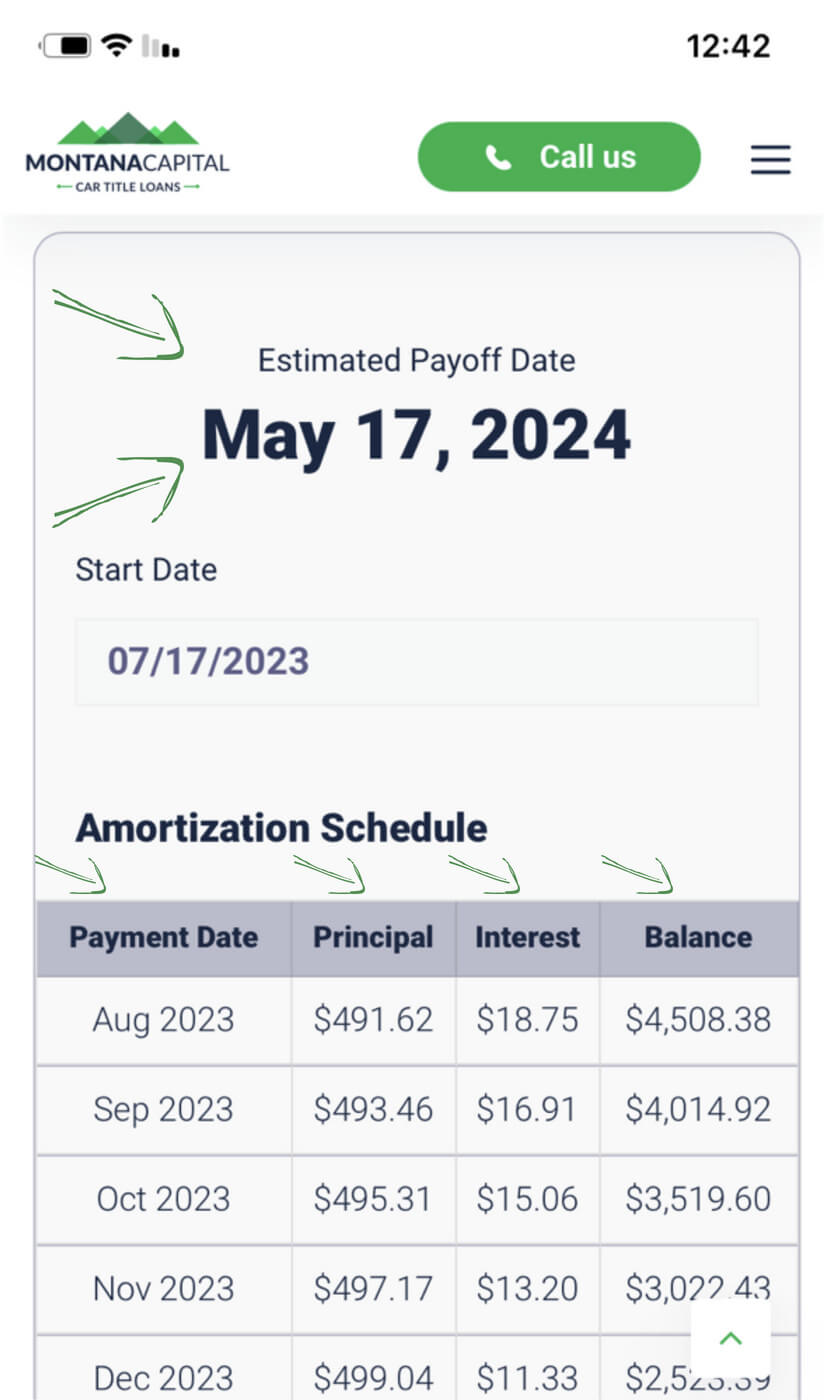

Estimated Payoff Date

May 14, 2026

Start Date

Amortization Schedule

| Payment Date | Payment | Principal | Interest | Total Interest | Balance |

|---|---|---|---|---|---|

| Aug 2025 | $510.37 | $491.62 | $18.75 | $18.75 | $4,508.38 |

| Sep 2025 | $510.37 | $493.46 | $16.91 | $35.66 | $4,014.92 |

| Oct 2025 | $510.37 | $495.31 | $15.06 | $50.71 | $3,519.60 |

| Nov 2025 | $510.37 | $497.17 | $13.20 | $63.91 | $3,022.43 |

| Dec 2025 | $510.37 | $499.04 | $11.33 | $75.24 | $2,523.39 |

| Jan 2026 | $510.37 | $500.91 | $9.46 | $84.71 | $2,022.49 |

| Feb 2026 | $510.37 | $502.79 | $7.58 | $92.29 | $1,519.70 |

| Mar 2026 | $510.37 | $504.67 | $5.70 | $97.99 | $1,015.03 |

| Apr 2026 | $510.37 | $506.56 | $3.81 | $101.80 | $508.46 |

| May 2026 | $510.37 | $508.46 | $1.91 | $103.70 | $0.00 |

*The data generated herein is completely and solely based on the information provided by you. The “title loans calculator” and calculation values are approximations and for illustration purposes only. It is not a part of the Montana Capital Car Title Loans application process. Actual payments may vary slightly. Rates used for calculations are not considered rate guarantees or offers. The calculations assume all payments are made when due.

Written by: Shir Amram

Simple Title Loan Calculator

When you need a quick cash loan, it’s important to know how much you can afford to pay back. Use our simple online title loan calculator to help you determine that amount. With our car title loans calculator, you don’t need to guess how much your loan might cost or how long the payment term should be. The easiest way to get an idea of the terms and costs of a title loan is using our user-friendly online calculator and then get a free title loans quote from us.

Car Title Loan Calculator: Estimate Your Title Loan

By using our title loan calculator, you can know ahead of time how much you need to pay back each month on your loan. Go to the blank fields and enter:

- Your Loan Amount: Think how much money you really need! Title loan amounts range from $500 to $50,000.

- Length of Loan Term: Select a loan term that aligns with your income and expenses. Most title loans have a duration of 12-48 months.

- Interest Rate Per Year: Understand the impact of the annual interest rate on your monthly payments. We charges interest rates between 60% to 175%.

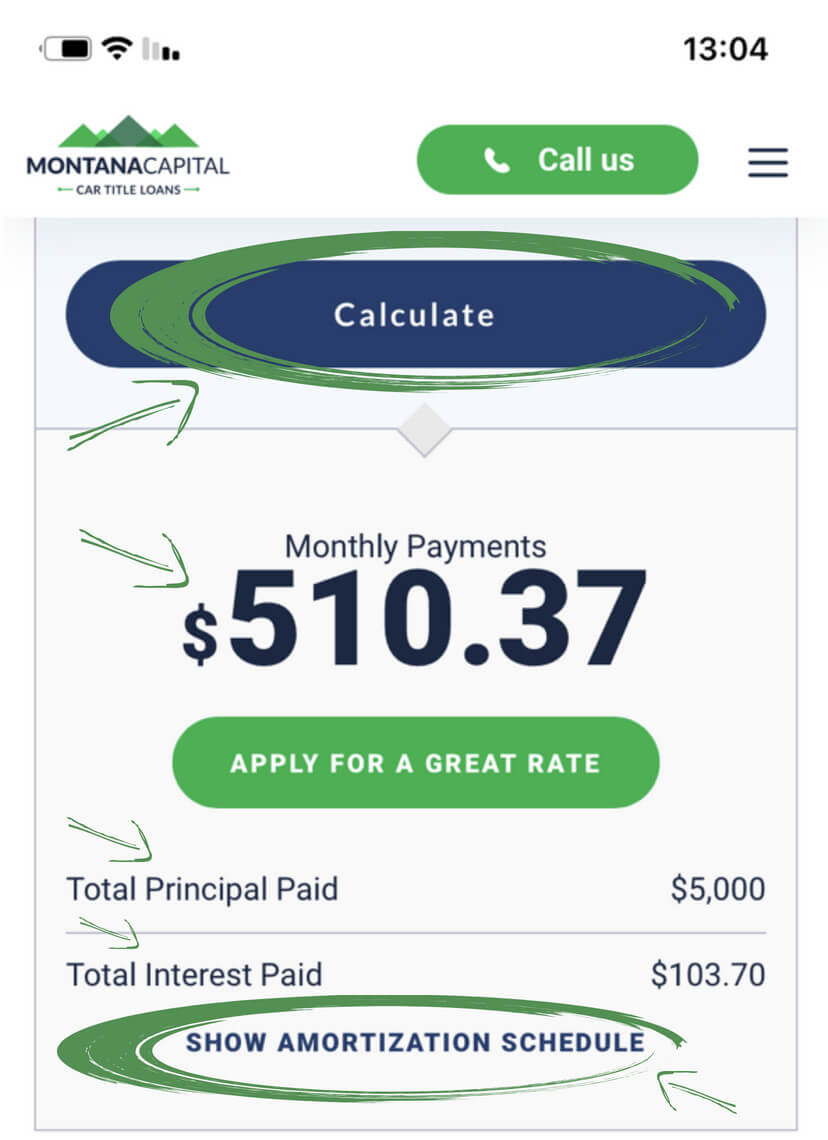

Hit the “Calculate Button” to see what your monthly payments will run.

Understanding the Calculations – Results:

- Monthly Payment Amount: This is the amount that will be due each month during the loan term

- Total Principal Paid: How much money you are borrowing against your vehicle’s title

- Total Interest Paid: The total amount you’ll pay in interest for the duration of your loan

See below how you can click on the button that says, “Show Amortization Schedule” to get your estimated payoff date. At the same time, you can review your complete amortization schedule, according to dates:

- Payment date

- Principal

- Total Interest

- Balance

What Is a Title Loan Calculator?

If you need a quick loan and want to get an easy estimate, without asking a typical lender, a title loan calculator is your tool. When you use it, you’ll see how easy it can be to get all the information you need to make your decision on a title loan. After you understand how much you can get, the amount you’ll be paying and how much it will cost, then you can call your lender or send in an online application. You can also use this information as comparison to different types of loans, such as personal loans, title loans or bad credit loans to make the best decision possible.

Find a Title Loan Calculator at Your Fingertips

Before looking for your next loan, take advantage of our easy-to-use car title loan calculator. It’s online and available all the time – anytime you need it. Find out how much the title loan you need will cost by reviewing the answers. By being well-informed ahead of time, you can make a wise title loan choice.

Taking Control with an Online Car Title Loan Calculator

Manage your personal finances by getting the information you need to make a responsible loan decision. Whether you make the choice to get the quick funds from a lender, you’ll understand the important details.

Getting a Title Loan up to 50% of Your Vehicle’s Value

In the title loan industry, you can generally secure a loan amount up to 50% of your car’s value, with same-day loan approval for up to $50,000.

However, our company offers a bit more flexibility, providing title loans up to 70% of your vehicle’s value, with loan amounts ranging from $500 to $50,000. This allows you to leverage more of your vehicle’s value for your financial needs.

Terms Used on a Title Loan Calculator

The reason consumers prefer using online car title loan calculators is because it gives them a leg up. Before they even reach out to lenders, they already know how much specific loan amounts will cost. This helps the consumer calculate the loan amount that is suitable for their needs. Before you commit to a title loan, do yourself a favor – use our convenient online auto title loan calculator before you get a loan.

Using the Online Calculator Requires a Few Basic Details:

- Preferred loan amount – Make a list of urgent financial needs to determine what size loan you actually need. To keep the monthly payment as low as possible, borrow the bare minimum. This will give you a lower monthly payment and you’ll end up paying less interest overall.

- Length of loan term – Your monthly payment amount will depend on how many months you will take to pay it back. The shorter the loan term, the less you’ll be accruing interest. When you take a longer loan term, your payments will be less but in the long run, you’ll end up spending more.

- Interest rates – You will need to pay interest on your loan, according to the loan value and the loan’s term. In the results on the title loan calculator, you can easily see how the annual interest rate (APR) will affect your loan amount due each month. In addition, the rate also affects how much your loan costs.

Let the title loan calculator help you with your informed loan decision. Compare rates offered by various lenders and check how the loan term changes your payment amount.

Examples Showing How a Car Title Loan Calculator Works

Look at the car title loan calculator results below and you’ll see there are two examples. You can notice how the end results for various types of vehicles can differ:

| Examples | 2017 Jeep Grand Cherokee | 2015 GMC Sierra 1500 |

| Vehicle Value | $19,610.00 | $15,920.00 |

| Title loan Amount | $9,000 | $4,500 |

| Up to 70% Car Value | 46% | 28% |

| Monthly Interest | 2.44% | 2.92% |

| APR | 29.30% | 35.07% |

| Loan Term | 24 Mo. | 12 Mo. |

| Fees | $90 | $90 |

| Monthly Payment Amount | $500.00 | $450.00 |

| Your total cost of taking this loan | $3,090.00 | $990.00 |

*Fees: Lien Recording Fee ($15) + Processing Fee ($75)

Calculate How Much Money You Can Get -Ask for Your Free Quote Now!

If you need money now, submit your basic details to Montana Capital Car Title Loans and you can get a free quote. Open an online title loan application and provide the following information:

Vehicle details:

- Type of car

- Car’s model

- Odometer reading

- Car style

Regarding your income:

- Where do you get your monthly income?

- Bank details or salary stub

- Other documents such as retirement funds or government benefits

Basic Personal Details:

- Address, including the state where you live

- Contact details: name, phone number, email address

- Zip code

Send in your online title loan application anytime and our qualified team of customer service representatives will calculate your loan terms. All eligible applicants can get the pre-approval quickly. When you get an offer, you’ll see exactly how much cash you can get by using your car title for loan security. Use the secure, online application today for quick answers.

Calculating the Terms of Your Online Title Loan

When you’re looking for a loan, the important factors that affect how much you’ll pay are the loan amount and the interest rate charged. The interest rate can vary, but the rate is affected by:

- The state where you live

2. Length of your loan term

3. Current value of your vehicle

4. Credit reports are sometimes required

Frequently Asked Questions

What’s the Lowest I Can Get for a Title Loan?

The minimum amount you can get for a title loan varies widely based on the lender and the state regulations where you live. Some lenders may offer title loans for as low as $100, while others may have a minimum loan amount of $1,000 or more. In some states, the minimum loan amount could be set by state law.

We offer up to 70% of the value of your car or other vehicle. The minimum loan amount begins at $500.

Can I Negotiate a Better Title Loan Deal?

Sure! You can discuss the different loan options with your lender. If you need a loan that is more affordable, find out if you can get a lower interest rate or if it’s better to take a longer loan term. These should give you a more affordable monthly payment amount. Make sure you can pay back your loan early without any pre-payment penalties or additional fees.

How Loan Terms Affect Total Loan Costs

Whatever length your loan term is will affect how much interest you need to pay. If you want to pay less interest, you can ask for a shorter loan term. Your monthly payment might be higher, but you’ll get it paid back faster.

What Affects the Total Interest on a Loan?

However much money you want to borrow (called the principal loan amount) has the greatest influence on how much interest you’ll need to pay. The higher your loan amount is, the more interest you’ll need to pay.

Save Time with the Title Loan Payment Calculator

When you locate and use the online title loan payment calculator, you can save yourself a lot of time. With the title loan payment calculator, you can stop running around from office to office comparing title loan prices. You can get an estimate of what your title loan will cost before you ever leave home. You can also play around with the numbers a little until you find a monthly payment amount that fits your budget. After putting in your details, the title loan payment calculator will issue a schedule of payments, so you’ll know how much you’ll pay and when each payment is due.

Take it From The Pros – Borrowing Tips From Lenders:

- Only borrow as much as you need and can repay according to the contract

- Title loans should be used for emergency funds, not as a long term financial solution

- Figure your expected monthly payment and payoff, with our handy title loan calculator

Let’s Get Started On Your Title Loan

To find out how much a title loan will cost, use our easy title loan calculator for a fast estimate.

To know how much cash you can get on your car, fill in our online car title loan application today!

Do you have a motorcycle? Figure out your monthly payment using the same simple motorcycle title loan calculator.

To understand more about how car title loans work, give us a fast call or have a look at our complete title loan info guide.

Written by

Shir Amram

Shir Amram is a senior loan officer at Montana Capital Car Title Loans. With over 10 years of experience in the finance industry, Shir has been an asset in her role and has contributed significantly to our company’s success, Shir’s academic background in economics and financial knowledge helps us fulfill our education mission as she creates a valuable content to our blog.