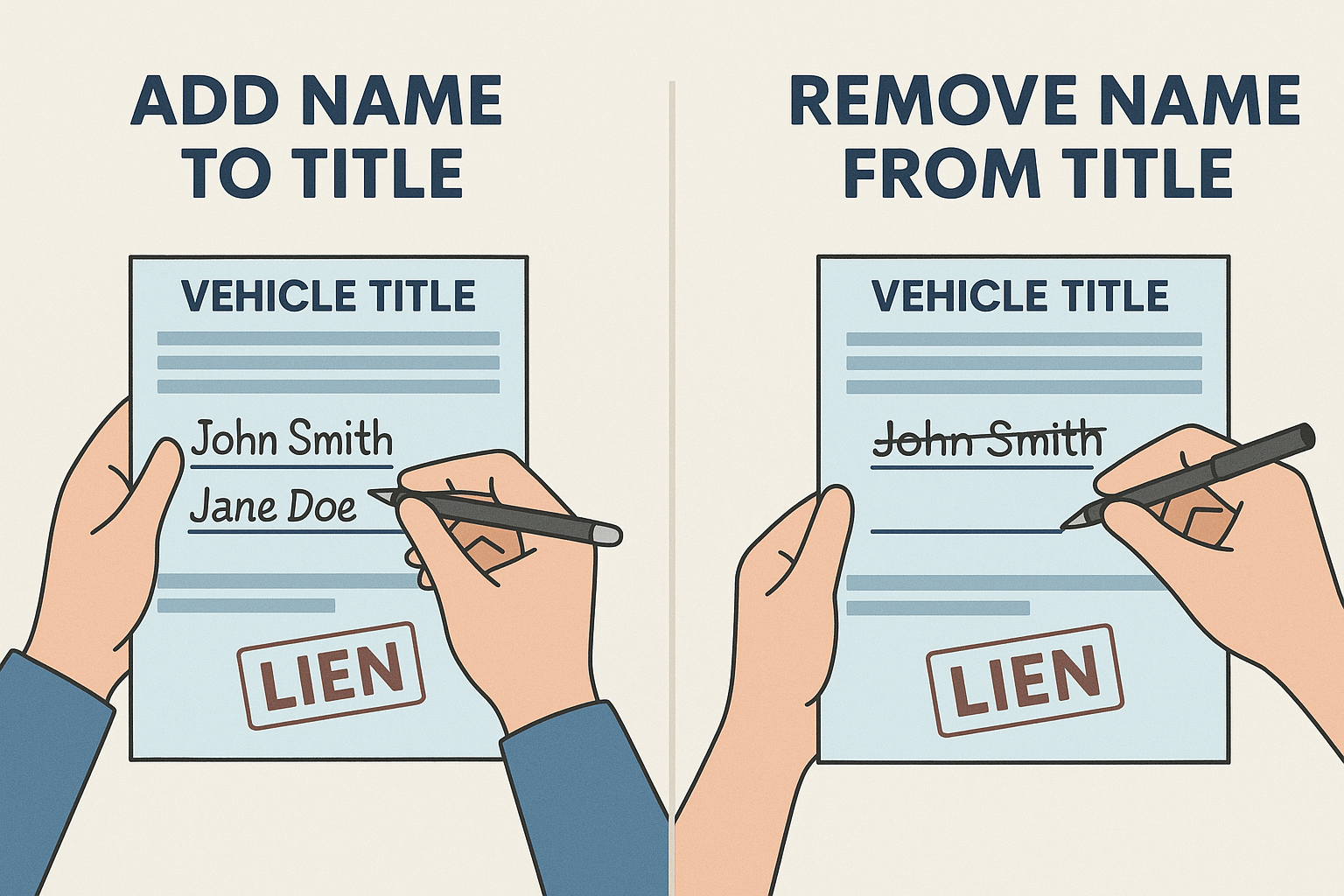

Adding a spouse to your car title after getting married? Trying to remove an ex after a divorce?

When your car has a loan, the process requires an extra step. This guide covers how to add or remove a family member, spouse, or co-owner from your title when there’s a lien on your vehicle.

Jump to Your Situation:

Jump to your situation:

- I want to add a name → Jump to “How to Add a Name”

- I want to remove a name → Jump to “How to Remove a Name”

- I need lienholder permission first → Start at “What If Your Car Has a Lien”

What If Your Car Has a Lien?

Yes, you can add or remove a name from your car title even if you have a loan. But you need your lienholder’s permission first.

The lienholder is the bank, credit union, or lender listed on your title. They have a legal claim on your car, which serves as collateral until you pay off the loan. Any title changes require their approval because the car is their protection if you stop paying.

How To Get Lienholder Permission

- Call your lender and request a title change authorization letter

- Explain who you want to add or remove and why

- Provide any documents they request (marriage certificate, divorce decree, etc.)

- Wait for written approval (usually 3-10 business days)

- Bring the approval letter to the DMV with your other documents

Some lenders charge a small fee for this letter. Others may require you to refinance the loan if you’re removing the primary borrower. Ask your lender about their specific requirements before visiting the DMV.

Key Takeaways

- Lienholder permission comes first. Contact your lender before going to the DMV.

- Adding a name works like a title transfer. You sign as the seller, then both names go on as buyers.

- Removing a name usually requires consent. The person being removed must sign unless you have a court order.

- “And” vs “or” matters for future decisions. Choose “or” if you want either owner to act alone later.

- Costs range from $15 to $75. Some states waive fees for family transfers.

- AAA members have an easier option. Many AAA offices can handle title changes for you.

How MontanaCapital® Handles Name Changes

If you have a title loan with Montana Capital, contact us before visiting the DMV. As your lienholder, we must authorize any car title name changes, whether you are adding or removing a name.

Our process is straightforward. Call us or email support@montanacapital.com.

Explain who you want to add or remove from the title and provide supporting documents, such as a marriage certificate, divorce decree, court order, or death certificate, depending on your situation.

After reviewing your request and supporting documents, we typically respond within 3–5 business days.

Upon approval, we issue a written lienholder authorization letter that you can submit to the DMV to complete the title name change.

There is no fee for this service. We want to help you update your title while keeping your loan in good standing.

How to Add a Name to Your Car Title

Adding a spouse, family member, or partner to your car title works like a partial title transfer. You’re essentially transferring a share of ownership to the new person.

Step 1: Get Lienholder Approval

Contact your lender first. Without their written permission, the DMV will reject your application.

Step 3: Complete the Title Transfer

Sign the back of your current title as the “seller.” Then both you and the person you’re adding sign as “buyers.” This creates joint ownership between you and your spouse, family member, or partner.

Step 4: Choose “And” or “Or”

Decide how you want ownership structured. This choice affects future decisions about selling, getting loans, or making title changes.

Step 5: Visit Your Local DMV

Both owners should be present whenever possible. If one person cannot attend, some states allow notarized signatures or a notarized power of attorney, depending on the situation.

Examples include: California (REG 227), Texas (Form VTR-271), and Florida (Form 82040).

Bring all required documents, lienholder authorization, and payment for the title fee. Requirements vary by state and county, so confirm with your local DMV before visiting.

Step 6: Receive Your New Title

You’ll get a new title with both names listed. Processing takes 2-4 weeks by mail. Some states offer expedited options.

How to Remove a Name From Your Car Title

Removing a spouse, ex-partner, or co-owner from your car title requires that person’s consent in most cases. The exception is when you have a court order.

Real example: One wife asked online about removing her husband’s name after their marriage ended.

The community confirmed she’d need his signature on the title, or a divorce decree awarding her the car. Her situation is common, and the process below covers exactly what to do.

Step 1: Get the Other Owner’s Agreement

The person being removed must sign the title. If they refuse, you may need a court order (common in divorce cases).

Step 2: Get Lienholder Approval

Contact your lender for written authorization. They may require you to refinance the loan if the remaining owner needs to qualify alone.

Step 3: Gather Your Documents

You’ll need:

- Current car title signed by both owners

- Valid ID for all parties

- Court order (if applicable, such as a divorce decree)

- Completed title application form

Step 4: Visit Your Local DMV

The person being removed signs as “seller.” The remaining owner signs as “buyer.” This transfers full ownership to one person.

Step 5: Pay the Transfer Fee

Fees range from $15 to $75 depending on your state. Some states waive fees for divorce-related transfers.

Typical Title Transfer Fees by State

| State | Typical Title Transfer Fee | Form |

|---|---|---|

| California (CA) | $15 | REG 256 |

| Texas (TX) | $28–$33 | Form 130-U |

| Florida (FL) | $75.25 | HSMV 82040 |

| Georgia (GA) | $18 | MV-1 |

Fees vary by state and county. Some states waive or reduce fees for divorce-related or court-ordered transfers. Always contact your local DMV for current fees and required forms.

“And” vs “Or” on Your Car Title

When two names appear on a title, the word between them matters. It determines who can make decisions about the car.

| Situation | “And” (Both Required) | “Or” (Either Can Act) |

| Selling the car | Both owners must sign | Either owner can sign alone |

| Getting a title loan | Both must apply together | Either can apply |

| Death of one owner | May require probate | Survivor owns outright |

| Removing a name | Both must consent | Either can initiate |

Which Should You Choose?

Choose “or” if you want flexibility. Either owner can sell, get a loan, or make changes alone.

Choose “and” if you want protection. Both must agree to any major decisions.

Special Lien Situations

Divorce

A divorce decree can override the need for your ex-spouse’s signature. Bring a certified copy to the DMV. The decree must specifically award the vehicle to you.

If your ex won’t sign and you don’t have a court order, file a motion with the family court. An attorney can help you get the proper documentation.

Death of a Co-Owner

If the title says “or,” the surviving owner can transfer with a death certificate. No probate needed.

If the title says “and,” you may need probate court. The process varies by state.

State Differences When a Co-Owner Dies

| State | Key Difference |

|---|---|

| California | May avoid full probate for small estates |

| Texas | Heir affidavit often accepted |

| Florida | Probate usually required |

| Georgia | Probate or court order required |

Note: Requirements vary by situation. Always confirm with your local DMV or probate court before proceeding.

The Other Person Won’t Sign

Without consent, your options are limited:

- Negotiate directly with the other owner

- Use mediation services

- Get a court order through divorce or legal proceedings

Frequently Asked Questions

Can AAA Handle Title Changes for Me?

Yes! Many AAA offices offer DMV services including title transfers.

Members can often skip the DMV line entirely. Call your local AAA branch to confirm they handle title changes in your state.

How Do I Avoid Gift Tax When Removing a Name?

In California, fill out the Statement of Facts (REG 256) form and mark it as a gift between family members. This can reduce or eliminate transfer taxes.

Other states offer similar exemptions for family transfers.

For example, Texas allows gift transfers between close relatives using a gift affidavit, Georgia often waives fees for divorce-related transfers, and Florida may exempt certain family transfers from additional taxes. Requirements vary by state, so always check with your local DMV.

What If My Ex-Spouse Lives in Another State?

They can sign the title and have it notarized in their state, then mail it to you.

Some states also allow electronic signatures. Check with your local DMV for specific requirements.

How Long Does the Lienholder Take to Respond?

Most lenders respond within 3-10 business days.

Credit unions tend to be faster (3-5 days). Large national banks may take the full 10 days. Call ahead to ask about their typical timeline.

Can I Remove a Deceased Person’s Name Myself?

If the title says “or,” yes. Bring the death certificate to the DMV.

If it says “and,” you may need to go through probate. The process varies by state and depends on the total value of the estate.

What Happens to the Lien If I Add Someone?

The lien stays on the title.

The new co-owner becomes jointly responsible for ensuring the loan gets paid. If payments stop, the lienholder can still repossess the car regardless of whose name is on the title.

Bottom Line

Adding or removing a name from your car title with a lien requires extra steps, but it’s manageable.

Start by contacting your lienholder for permission. Gather all documents before visiting the DMV. And remember that your choice of “and” or “or” will affect future decisions about your car.

Need a Title Loan?

Montana Capital offers title loans for vehicles, even if you need to make title changes. We work with you to ensure your loan stays in good standing. Call us or apply online with no obligation.

Related Resources