A Complete Guide to Secured Borrowing

When traditional loans seem out of reach due to poor credit or high interest rates, collateral loans offer a powerful alternative that can unlock better borrowing terms. Whether you’re looking to finance a major purchase, consolidate debt, or access cash for unexpected expenses, understanding how do collateral loans work can open doors to more affordable financing options.

Unlike unsecured loans that rely solely on your creditworthiness and income, collateralized loans use valuable assets as security, creating a win-win situation where lenders face reduced risk and borrowers enjoy lower interest rates and higher approval odds.

Key Takeaways

- Collateral loans are secured loans where borrowers pledge valuable assets like cars, homes, or savings accounts to guarantee loan repayment

- These loans typically offer lower interest rates than unsecured loans because the collateral reduces the lender’s risk

- If you default on payments, the lender can legally seize and sell your collateral to recover the debt

- Common collateral loan types include auto loans, mortgages, home equity loans, and secured personal loans

- Borrowers with poor credit can often qualify for collateral loans when they might be denied unsecured financing

What Are Collateral Loans?

A collateral loan, also known as a secured loan, is a type of financing where borrowers pledge valuable assets to guarantee loan repayment. When you take out such loans, the lender gains a legal claim called a lien on your property pledged as security. This arrangement fundamentally changes the risk equation for both parties involved. According to the Consumer Financial Protection Bureau (CFPB), secured loans allow lenders to offer lower interest rates because collateral reduces their exposure to loss.

The basic concept is straightforward: if you repay the loan according to the agreed terms, the lender releases their claim on your asset. However, if the borrower fails to make monthly payments, the financial institution has the legal right to seize and sell the collateral to recover their losses.

This differs significantly from unsecured loans, which rely entirely on your payment history, debt to income ratio, and overall financial health. With unsecured loan options, lenders have no specific asset to claim if you default on your loan, making them riskier for lenders and typically more expensive for borrowers.

The collateral value typically determines the maximum loan amount you can access. Most lenders offer between 70-90% of an asset’s appraised value, ensuring they can recover their investment even if the property’s value declines.

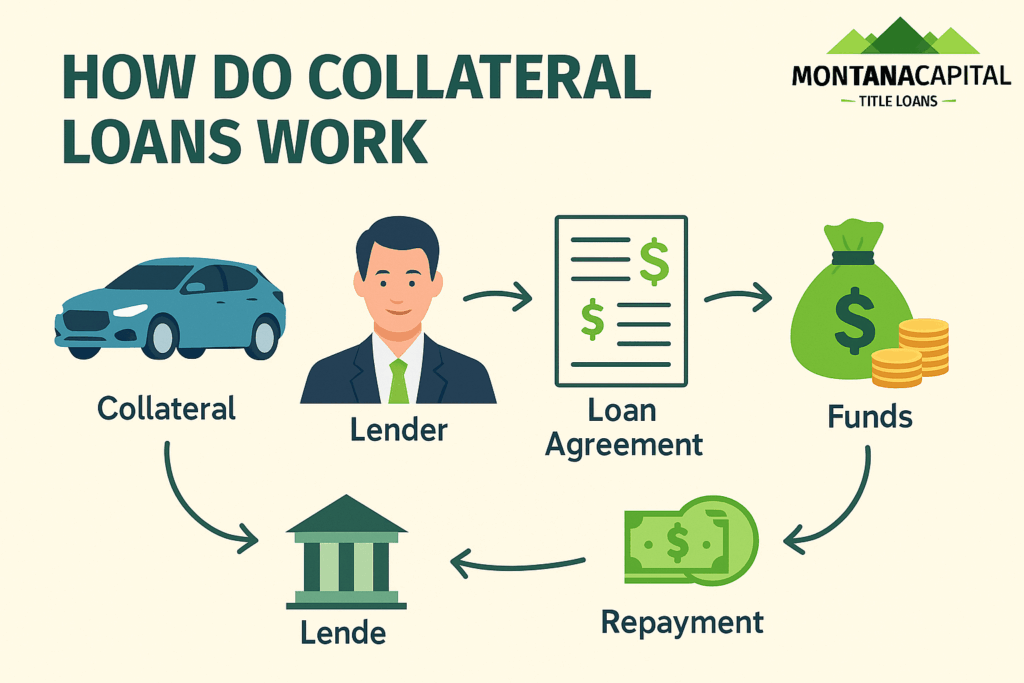

How Collateral Loans Work: The Step-by-Step Process

Understanding how collateral loans work requires breaking down the process into manageable steps. The approval process for loans secured by assets follows a more detailed path than traditional unsecured financing.

- Application Process: You begin by completing a loan application and identifying the asset you’ll use as collateral. The lender evaluates both your financial history and the proposed security. Financial institutions require documentation proving ownership of the asset and your ability to make monthly payments.

- Asset Evaluation: The lender assesses your collateral value through professional appraisals for real estate or market research for vehicles and other assets. This step is crucial because it determines your maximum borrowing capacity and helps establish the loan’s risk profile.

- Loan-to-Value Ratio: Lenders typically offer 70-90% of the collateral’s appraised value, not 100%. For example, if your vehicle is worth $20,000, you might qualify for a secured loan up to $16,000. This buffer protects the lender against potential depreciation or market fluctuations, as outlined by the Federal Deposit Insurance Corporation (FDIC) in its loan risk management guidelines.

- Legal Documentation: Once approved, you’ll sign agreements that create a lien on your asset. For vehicles, this means the lender’s name appears on your title. For real estate, the lien is recorded with local government offices, creating a public record of the financial institution’s claim.

- Repayment Terms: Your loan terms include the interest rate, monthly payment amount, and loan duration. Interest rates on secured loans are typically 2-5 percentage points lower than unsecured alternatives due to the reduced lender’s risk.

- Default Consequences: If you miss payments, the timeline for repossession typically begins after 90-120 days of delinquency. The Federal Trade Commission (FTC) notes that state laws determine the exact process and notice period before lenders can seize collateral.

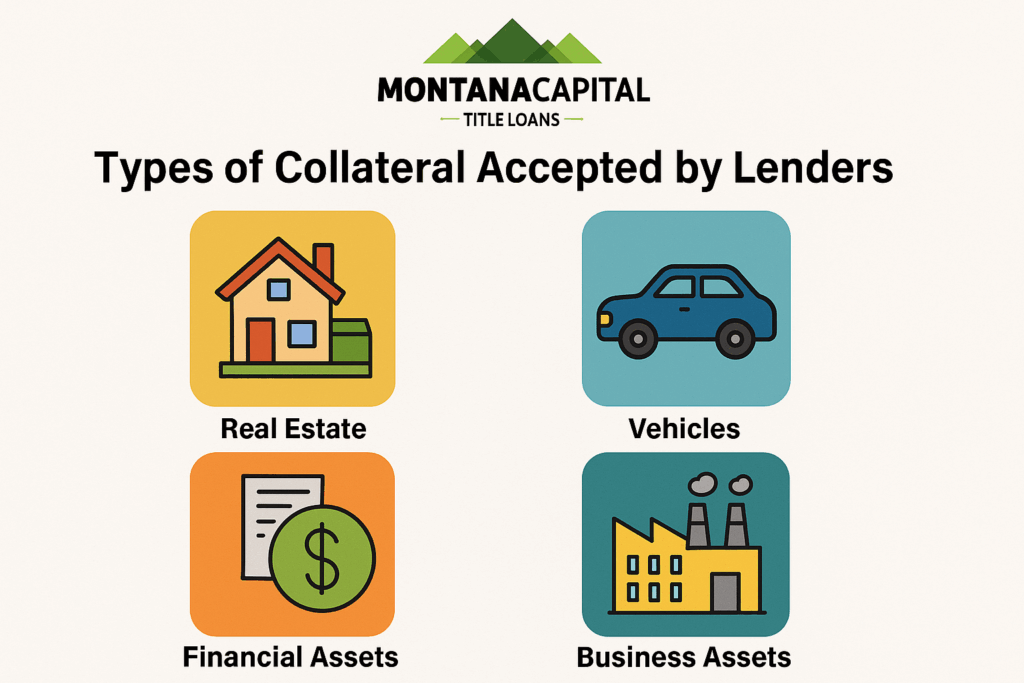

Types of Collateral Accepted by Lenders

Not all assets qualify as acceptable security for collateralized loans. Lenders prefer assets that maintain value, have clear ownership documentation, and can be easily liquidated if necessary. Here are common examples of collateral that lenders accept:

- Real Estate: Primary homes, vacation properties, and investment properties represent the most common and valuable collateral types. Real estate typically appreciates over time and provides substantial security for larger loan amounts. Lenders readily accept property with clear titles and sufficient equity. Home equity loans and second mortgages are common loan types that require collateral in the form of your home’s equity.

- Vehicles: Cars, trucks, motorcycles, boats, and RVs serve as collateral for many loans. For personal loans secured by vehicles, the asset must typically be fully paid off. However, auto loans for vehicle purchases use the financed vehicle itself as security.

- Financial Assets: Savings accounts, certificates of deposit, and investment portfolios offer excellent collateral because their value is easily determined and accessible. Many financial institutions offer particularly favorable terms when you use their own deposit accounts as security.

- Business Assets: Equipment, inventory, and accounts receivable can secure business loans. Manufacturing companies might pledge machinery, while retailers could use inventory. Service businesses often leverage outstanding invoices through invoice financing arrangements.

- Other Valuable Items: Some lenders accept jewelry, fine art, or collectibles, though this is less common and requires specialized appraisal expertise. These items can be challenging to value and liquidate, making them less attractive to traditional lenders.

- Assets NOT Typically Accepted: Retirement accounts like 401(k)s and IRAs cannot serve as collateral due to federal regulations. Personal belongings without significant resale value, such as furniture or electronics, are also generally unacceptable.

Common Types of Collateral Loans

The secured lending market includes various loan products, each backed by different asset types to suit your financial needs.

Auto Loans

Auto loans use the vehicle you purchase as collateral, simplifying approval even with limited credit history. Terms usually range from 3-7 years, with interest rates between 3-8% for good credit. Loan-to-value ratios can reach 80-100% for new cars. Missing payments for 60-90 days can lead to repossession, where the lender sells the vehicle to recover the debt. If sale proceeds fall short, you remain responsible for the balance.

Mortgages and Home Loans

Mortgages are the largest type of collateral loans, with the property serving as security. Terms typically span 15-30 years, with rates around 6-8% in 2024. Loan amounts can reach up to 97% of the property value with some programs, though conventional loans often require 20% down to avoid PMI. Foreclosure begins after about 120 days of missed payments, with state laws affecting the process. PMI protects lenders if you default early and can be removed once you gain 20% equity.

Home Equity Loans and HELOCs

These loans let you borrow against your home equity, using your property as collateral. Borrowing usually maxes out at 80-85% of your home’s value minus existing mortgage balances. Home equity loans provide lump sums with fixed rates, while HELOCs offer revolving credit with variable rates. Both carry foreclosure risks if you default.

Secured Personal Loans

Secured personal loans offer flexible collateral options like savings accounts, investment accounts, or vehicles. Loan amounts range from $1,000 to $100,000, with interest rates between 3-15%, lower than unsecured loans. Common uses include debt consolidation, home improvements, and emergencies. The approval process is faster due to reduced lender risk, but default risks losing your pledged collateral.

Collateral Loan Rates Comparison

| Type of Loan | Typical Interest Rate Range | Loan Term | Collateral Used | Notes |

| Auto Loans | 3% – 8% | 3 – 7 years | Vehicle | New cars may qualify for higher loan-to-value ratios |

| Mortgages | 6% – 8% | 15 – 30 years | Residential Property | Rates vary by credit and down payment |

| Home Equity Loans | 5% – 7% | 5 – 30 years | Home Equity | Fixed lump sum, often lower rates |

| Home Equity Line (HELOC) | 5% – 7% (variable) | Revolving credit | Home Equity | Flexible borrowing, variable rates |

| Secured Personal Loans | 3% – 15% | 1 – 10 years | Savings Account, Vehicle, or Other Assets | Rates depend on collateral type and creditworthiness |

Benefits and Risks of Collateral Loans

Collateral loans balance attractive borrowing terms with the risk of losing your asset. Knowing both helps you decide if secured financing suits your financial goals and risk tolerance.

Benefits

- Lower Interest Rates: Secured loans offer rates 2-5 points lower than unsecured loans, saving thousands over time. For example, a $20,000 loan at 8% versus 15% saves about $7,000 in interest over five years.

- Higher Approval Rates: Borrowers with credit scores of 580-650 often qualify for collateralized loans when unsecured loans are denied. Offering collateral reduces lender risk, improving approval chances.

- Larger Loan Amounts: You can borrow up to 85-90% of your collateral value, enabling access to more funds for major expenses like home improvements or debt consolidation.

- Longer Repayment Terms: Real estate-backed loans may extend up to 30 years, lowering monthly payments. Secured personal loans also often have longer terms than unsecured ones.

- Credit Building: Timely payments on secured loans help improve your credit score, leading to better financial opportunities.

Risks

- Asset Loss: Defaulting risks losing your collateral, such as your home or vehicle, as lenders can seize and sell it to recover debt.

- Negative Equity: You may owe more than your collateral’s worth, especially with depreciating assets like cars, complicating loan payoff.

- Additional Fees: Costs like appraisal fees ($300-500), origination fees (1-3%), and title insurance increase total borrowing expenses.

- Limited Flexibility: Collateral ties up your asset, restricting your ability to sell or modify it without lender approval.

- Potential Larger Losses: If collateral value exceeds your debt, defaulting could cost you more than the loan amount, unlike unsecured debt.

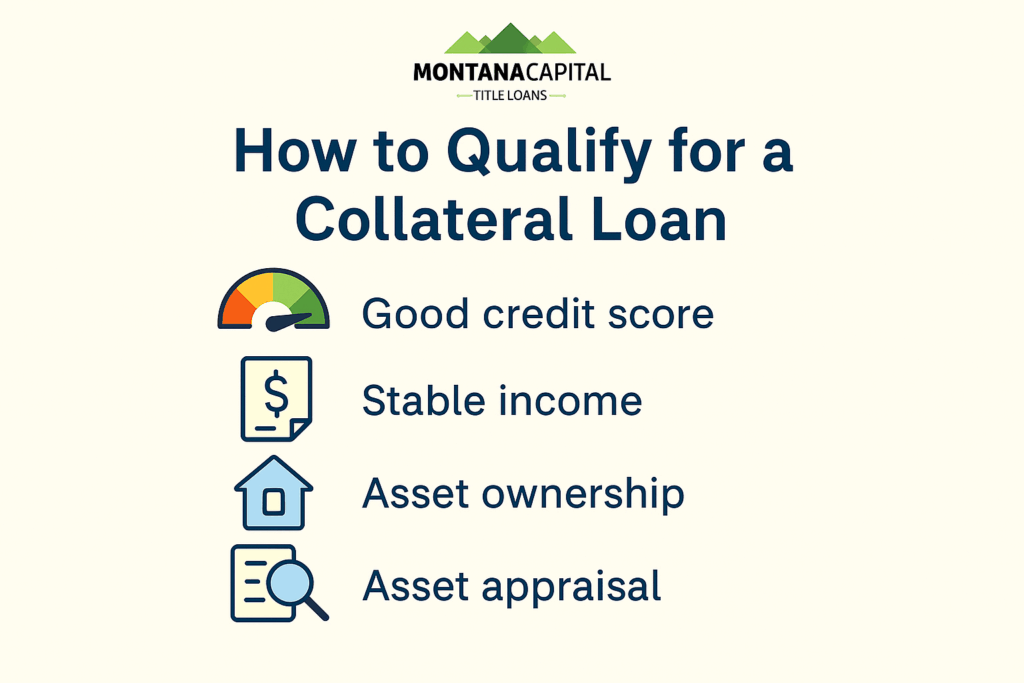

How to Qualify for a Collateral Loan

Securing approval for loans secured by assets involves meeting both creditworthiness and collateral requirements. While standards vary among lenders, understanding common qualification criteria helps you prepare effectively.

- Credit Requirements: Most lenders require credit scores of 580-620 or higher for secured loans, though some accept lower scores given sufficient collateral. Your payment history carries significant weight, as lenders want evidence of responsible debt management even when loans secured by collateral are involved.

- Income Verification: Lenders typically require debt-to-income ratios under 43%, ensuring you can handle monthly payments alongside existing obligations. You’ll need to provide pay stubs, tax returns, and bank statements demonstrating stable income sufficient to support the new debt.

- Collateral Documentation: Proper documentation proving asset ownership is essential. This includes vehicle titles, property deeds, account statements, or other official records. Any liens or encumbrances on the asset must be disclosed and may affect loan approval.

- Appraisal Process: Professional evaluation determines your collateral’s current market value. Real estate requires licensed appraisers, while vehicles use resources like Kelley Blue Book values. The appraisal directly impacts your maximum loan amount and terms.

- Shopping for Lenders: Different financial institutions offer varying terms and accept different collateral types. Banks often provide competitive rates for customers with existing relationships, while credit unions may offer attractive terms to members. Online lenders increasingly compete in the secured loan space with streamlined processes.

- Required Documentation: Gather necessary paperwork before applying, including recent tax returns, pay stubs, bank statements, and asset ownership documents. Having complete documentation accelerates the approval process and demonstrates your preparedness to lenders.

Consider working with multiple lenders to compare offers, as terms can vary significantly. Don’t forget to factor in all costs, including fees and insurance requirements, when evaluating different options.

Is a Collateralized Loan Right for You?

Deciding whether a collateralized loan fits your financial needs depends on your goals, credit profile, and risk tolerance.

If you have valuable assets to offer as collateral and want access to lower interest rates or larger loan amounts, secured loans can be an excellent option. They often provide more flexible terms and higher approval chances, especially if your credit score is less than perfect. However, you should carefully consider the risk of losing your pledged collateral if you default on payments.

Assess your financial situation, repayment ability, and comfort with this risk before choosing a collateral loan. Consulting with a financial advisor can also help you make an informed decision.

Ready to Explore Your Options?

Fill out our online request form today to see which loan you qualify for and how much you can borrow, completely without obligation.

Frequently Asked Questions

Can I Use My Collateral While the Loan is Active?

Yes, you typically retain possession and use of your collateral during the loan term. For vehicles, you can drive them normally, and for homes, you continue living there. However, the lender holds a lien on the asset, meaning you cannot sell or transfer ownership without their permission. You’re also responsible for maintaining the asset in good condition and carrying appropriate insurance.

What Happens If My Collateral Loses Value During the Loan Term?

If your asset’s value drops below your outstanding loan balance, you’re in a negative equity position. While this doesn’t trigger immediate action from the lender, it becomes problematic if you need to sell the asset or if you default. Some lenders may require additional collateral or partial loan paydown if the value decline is severe. It’s important to monitor your loan-to-value ratio, especially with depreciating assets like vehicles.

How Long Does the Collateral Loan Approval Process Typically Take?

The timeline varies by loan type and lender. Secured personal loans using financial assets might be approved within days, while mortgages typically take 30-45 days due to extensive documentation and appraisal requirements. Auto loans for vehicle purchases often close within a week. The key factors affecting timing include appraisal scheduling, title searches for real estate, and the completeness of your application.

Can I Pay Off a Collateral Loan Early Without Penalties?

Most secured loans allow early repayment without penalties, though you should verify this in your loan agreement. Some lenders, particularly for mortgages, may charge prepayment penalties during the first few years. Early payoff releases the lien on your collateral and can save significant interest costs. Always confirm prepayment terms before signing any loan agreement.

What’s the Difference Between a Lien and Actual Ownership of My Collateral?

A lien gives the lender a legal claim against your asset but doesn’t transfer ownership. You retain title and possession, can use the asset normally, and benefit from any appreciation in value. The lien simply ensures the lender can claim the asset if you default. Once you repay the loan, the lien is released and you regain clear ownership. This differs from some alternative financing arrangements where you might actually transfer ownership temporarily.