Can I Get a Title Loan Without Proof of Income?

Lenders require proof of income to determine your ability to repay a title loan, and you must have some form of proof of income to qualify. However, this does not necessarily mean you need proof of traditional employment, as there are different options available to demonstrate your income.

Lenders may accept alternate forms of income verification, such as disability grants, retirement benefits, or alimony, especially for those in unique financial situations that may require alternative documentation.

How is This Possible?

Proof of income and proof of employment are two different things.

While proof of employment shows that you have a job, proof of income demonstrates that you have a reliable source of funds to make your loan payments. Even without a traditional job, you can qualify for a title loan by providing documentation of income from alternative sources.

As long as you can show consistent income sufficient to cover your loan repayments, lenders may approve a title loan without requiring employment verification.

- How Title Loans Work

- Example of a Title Loan Without Traditional Proof of Income

- Where Can I Get a Title Loan Without Proof of Income?

- How to Qualify for Car Title Loans Without Income Verification?

- Vehicle Qualifications for Title Loans

- Interest Rates and Terms to Expect

- Benefits of Title Loans Without Proof of Income

- Risks Involved with Title Loans

- Tips for Strengthening Your Title Loan Application

- Important Information You Must Know Before Getting a Title Loan

- Conclusion

How Title Loans Work

Title loans are secured loans that use your vehicle’s title as collateral. An auto title loan is a type of secured loan where the vehicle title serves as collateral, making the vehicle’s title a crucial part of the loan process.

The amount you can borrow typically depends on the equity you have in your vehicle, which is the current market value of your car minus any outstanding loans or liens. Lenders assess the vehicle’s value to determine the maximum loan amount they can offer. While you retain possession and use of your vehicle during the loan term, the lender holds the title until the loan is fully repaid.

Auto title loans are a common way to access funds quickly, especially for those who may not have traditional income verification.

When applying for a title loan, lenders look for:

- Vehicle Equity: The value of your car that can be used as collateral, with the vehicle title serving as security for the loan.

- Income Verification: Proof that you have a reliable source of income to repay the loan, which may come from various alternative sources beyond traditional employment.

Lenders may also conduct a credit evaluation to determine your eligibility and the loan amount for auto title loans.

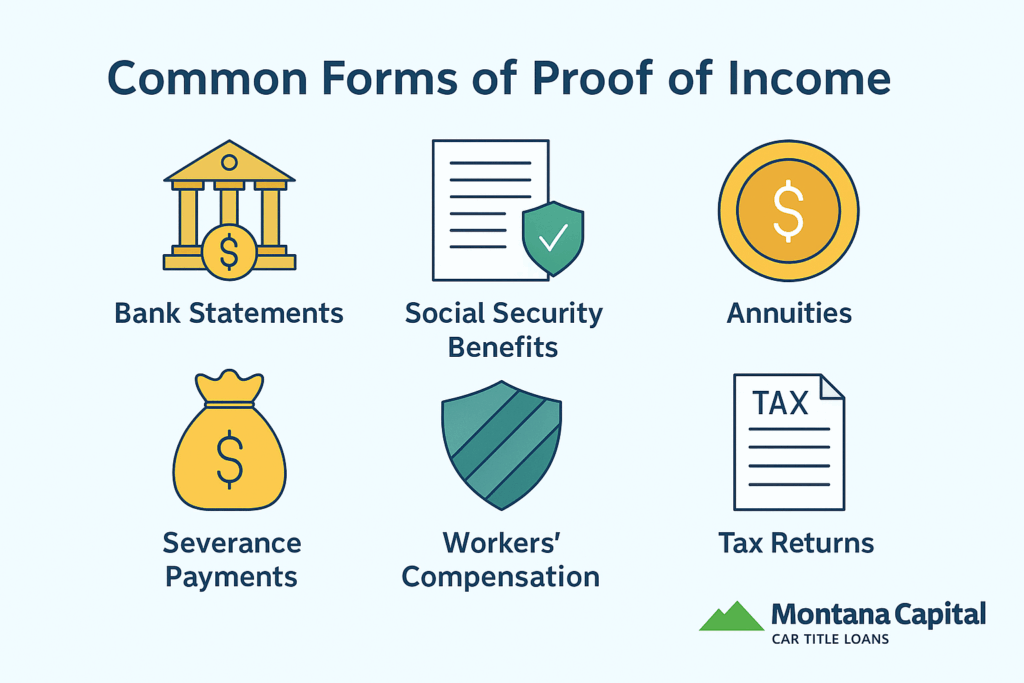

Common Forms of Proof of Income

Lenders accept various types of documents as proof of income beyond traditional pay stubs. These include:

- Bank Statements: Showing regular deposits that demonstrate consistent income. Bank account statements can serve as reliable documentation of earnings and financial stability.

- Social Security Benefits: Retirement or disability payments can serve as reliable income proof.

- Annuities: Regular payments from annuity contracts provide steady income.

- Severance Payments: Documentation of a severance payment, which is a form of financial support from a former employer.

- Workers’ Compensation: Benefits received due to work-related injury or illness.

- Trust Fund Income: Regular disbursements from trust funds can be used as proof of financial stability.

- Inheritance or Settlement Income: Court-ordered settlements, such as a monetary settlement ordered from a lawsuit, or inheritance payments.

- Tax Returns: Especially useful for self-employed individuals to prove income.

Why Proof of Income Matters

Lenders use proof of income to evaluate your ability to meet the monthly payments on a title loan, and it is important to demonstrate your ability to repay the loan. This protects both you and the lender by ensuring the loan is manageable and reduces the risk of default.

Providing accurate and verifiable proof of income increases your chances of loan approval and may also help you access better loan options, including competitive interest rates and flexible repayment schedules.

Example of a Title Loan Without Traditional Proof of Income

John, a 62-year-old retiree, needed quick access to $3,000 to cover unexpected medical expenses. Without a traditional job or pay stubs, he used an online title loan service to apply from home. John submitted his Social Security award letter along with recent bank statements showing consistent monthly deposits from his Social Security benefits and pension.

Using his clear car title as collateral, the lender verified his alternative income documents and approved the loan within a few hours. John received the funds the same day, demonstrating how borrowers without traditional proof of income can successfully obtain title loans through a fast, convenient online process.

Where Can I Get a Title Loan Without Proof of Income?

We provide a reliable service to help you with finding title loans through online platforms, making it simple to locate trustworthy lenders. Our process is designed to make it easy for you to apply for an online title loan and access fast cash even if you don’t have traditional income verification.

We accept various alternative income documents, and our online title loans are available for borrowers with non-traditional income sources. We guide you through the application smoothly, working with title lenders who specialize in flexible income verification.

A title loan company facilitates the process by handling fast approvals and managing the transfer of your vehicle title as security for the loan.

The Process to Get Title Loan Without Proof of Income

Getting a title loan without proof of income is simple with our streamlined application process, which involves just 3 easy steps. Before applying, make sure to get a car title in your name, as this is required:

- Apply Online: Submit your application through our secure online platform. Provide basic information about yourself and your vehicle, including personal identification and a valid ID as part of the application.

- Submit Alternative Income Documents: Instead of traditional pay stubs, upload alternative proof of income such as bank statements, social security benefits, annuities, or other acceptable documents.

- Fast Approval and Funding: Once we verify your documents and vehicle details, you’ll typically receive fast approval and can access funds in just a few hours, often on the same day.

How to Qualify for Car Title Loans Without Income Verification?

When applying for a car title loan without traditional income verification, lenders typically require the following documents to verify your income and personal identification:

- Vehicle’s clear title in your name

- Valid government-issued photo identification (such as a driver’s license or passport); a valid ID is required

- Proof of address (utility bills or lease agreements)

- Proof of vehicle registration and insurance

- Proof of income (using one or more of the alternative documents mentioned above, such as bank account statements)

- Personal references with contact information (depending on lender requirements)

Vehicle Qualifications for Title Loans

To qualify for a car title loan, your vehicle must meet specific requirements set by the lender. Most importantly, you need to have a clear title in your name, meaning the car is fully paid off and free of any liens.

Lenders will also assess the value of your vehicle, taking into account factors such as the make, model, year, mileage, and overall condition. This evaluation helps determine the maximum loan amount you can receive. In many cases, lenders may require you to provide proof of insurance to ensure the vehicle is protected during the loan period.

By using your car title as collateral, you can access fast cash and emergency funds, even if you don’t have traditional proof of income. Meeting these vehicle qualifications is essential for securing a title loan and addressing urgent financial needs.

Interest Rates and Terms to Expect

When considering car title loans, it’s important to understand the interest rates and loan terms you may encounter. Title loans typically come with higher interest rates than traditional loans, with monthly rates often ranging from 10% to 30%.

Repayment terms are usually short, sometimes just a few months, though some lenders may offer longer terms or installment plans. Many lenders provide options for automatic payments to help you stay on track with your monthly payments.

Before signing a loan agreement, carefully review all terms, including the interest rate, repayment schedule, and any additional fees. Understanding your financial situation and the specifics of your loan will help you avoid surprises and ensure you can manage your payments responsibly.

Benefits of Title Loans Without Proof of Income

- Access fast cash and emergency funds without traditional income verification

- Suitable for self-employed, retirees, and those with alternative income sources

- Available even with bad credit or no steady job

- Use your vehicle’s title as collateral

- Flexible repayment plans and competitive rates from many lenders

- Convenient personal loan option for urgent financial needs

Risks Involved with Title Loans

- Risk of vehicle repossession if monthly payments are missed or loan defaults

- High interest rates can make repayment difficult

- Potential for falling into a cycle of debt

- Importance of reviewing loan agreement and terms carefully

- Work only with reputable lenders with transparent terms

- Ensure affordability of monthly payments before committing

Tips for Strengthening Your Title Loan Application

To improve your chances of approval when providing proof of income, consider the following:

- Organize Your Documents: Ensure all paperwork is current, accurate, and easy to review.

- Demonstrate Consistency: Provide records that show steady income over several months.

- Be Transparent: Clearly explain your income sources to the lender, especially if they are non-traditional.

- Maintain a Clear Car Title: Having a lien-free title in your name simplifies the loan process.

- Communicate Openly: If you have questions or unique income situations, discuss them with your lender upfront.

- Understand Your Credit Evaluation: Knowing how your credit evaluation affects eligibility and loan amount can help you prepare a stronger application.

- Explore Loan Options: Compare different loan options, including repayment plans and interest rates, to find the best fit for your financial needs.

Important Information You Must Know Before Getting a Title Loan

A title loan should be considered a last resort and used only for emergencies. While it can provide quick access to cash, it carries significant risks and can lead to a cycle of debt if not managed carefully.

- High Risk of Debt: Title loans often have high interest rates and short repayment periods, increasing the chance of falling behind on payments and losing your vehicle.

- Vehicle Repossession: Failure to repay the loan can result in the lender repossessing your car, which may severely impact your mobility and financial stability.

- Explore Alternatives: Before applying, consider other options such as personal loans, credit counseling, or assistance programs that may offer safer financial solutions.

- Protect Your Privacy: Only share your personal and financial information with licensed, reputable lenders to avoid fraud.

- Get Expert Guidance: Consult financial advisors or visit trusted resources like the Consumer Financial Protection Bureau (CFPB) or Federal Trade Commission (FTC) for advice on managing debt and understanding title loans.

Using a title loan responsibly means understanding these risks and considering all alternatives before proceeding.

Conclusion

Proof of income is a vital component in obtaining a car title loan, but it does not have to come from a traditional job. Lenders recognize various alternative income sources and accept multiple forms of documentation to verify your ability to repay.

By gathering the appropriate proof of income and meeting loan eligibility requirements, you can access fast cash when facing financial difficulties. Always review your loan terms carefully and borrow responsibly to make the most of your title loan experience.

If you’re ready to apply, gather your essential documents and apply online for a quick decision and potential same-day funding.