Removing a lien means getting a clean title that proves you own the vehicle free and clear, with no lender claims against it.

What You Need to Know About Removing a Lien

Once you pay off your car loan, you expect a clean title in the mail. It should happen automatically, but that is not always the case.

Sometimes lenders forget to send the paperwork. The company might have gone out of business, or an old lien from years ago still appears on your title even though you paid it off long ago.

The good news is that removing a lien is usually straightforward. This guide walks you through what to do, what documents you need, and how long the process takes.

Not sure whether your car has a lien? Start by learning how to check if a car has a lien before moving forward.

Key Takeaways

- Most lenders release liens automatically through electronic systems. You should receive a clean title by mail within 7 to 10 business days after payoff.

- If your lender does not use electronic release, request a lien release letter. Bring it to your local DMV along with your current title to get a clean title issued.

- By law, lenders must release your lien within 3 to 10 business days after you pay off the loan. Contact them directly if two weeks pass without any update.

- If the lienholder went out of business, check the FDIC Failed Bank List or your state’s Secretary of State database to find out who took over their accounts.

- Title fees range from $15 to $33 depending on your state. Some states offer free replacement titles after electronic lien release.

Documents You Will Need to Remove a Lien at the DMV

Gather these items before heading to the DMV so you can get your clean title in one visit.

| Document | Details |

| Vehicle Title | Must be the original title, not a photocopy |

| Lien Release Letter | On company letterhead, signed by authorized officer |

| Proof of Payoff | Bank statement or paid-in-full letter from lender |

| Valid ID | Driver’s license or state-issued ID |

| Title Fee | $15 to $33 depending on state (see state section below) |

Tip: Some states, such as California DMV and Georgia DOR, allow certain title and lien paperwork to be submitted by mail or handled electronically through their DMV systems.

This can save you time and effort by completing parts of the process online.

How to Remove a Lien From Your Car Title Step by Step

The exact process depends on your state, but the steps are similar everywhere. Here’s what to expect.

Confirm Your Loan Is Fully Paid Off

Check your final loan statement or call your lender to confirm the balance is zero. Keep a copy of this proof because you may need it if questions come up later.

Wait for Automatic Electronic Release

Easiest option. No action required. Most lenders use Electronic Lien and Title (ELT) systems that notify your state DMV as soon as you pay off the loan. Your DMV then mails you a clean title automatically.

This usually takes 7 to 10 business days. If you do not receive anything within two weeks, move to Step 3.

Request a Lien Release Letter From Your Lender

Best when lender does not use ELT. Call or email your lender and ask for a lien release letter on their official letterhead.

The letter should include your name, vehicle year, make, model, and VIN. It must clearly state that the lien is satisfied and be signed by an authorized officer.

Submit Your Documents to the DMV

Final step to get your clean title. Bring your lien release letter, current title, ID, and fee to your local DMV office or county tax office, depending on your state.

They will issue a new title without the lien listed. In-person visits often get processed same day. Mail-in requests take 2 to 6 weeks.

How Long Does It Take to Remove a Lien From a Car Title

The timeline to get your clean title depends on which method your lender uses and how you submit your paperwork to the DMV.

| Lien Release Method | Expected Timeline |

| Electronic lien release (ELT) | 7 to 10 business days |

| Paper release, in person | Same day to 1 week |

| Paper release, by mail | 2 to 6 weeks |

| Court-ordered title | Several weeks to months |

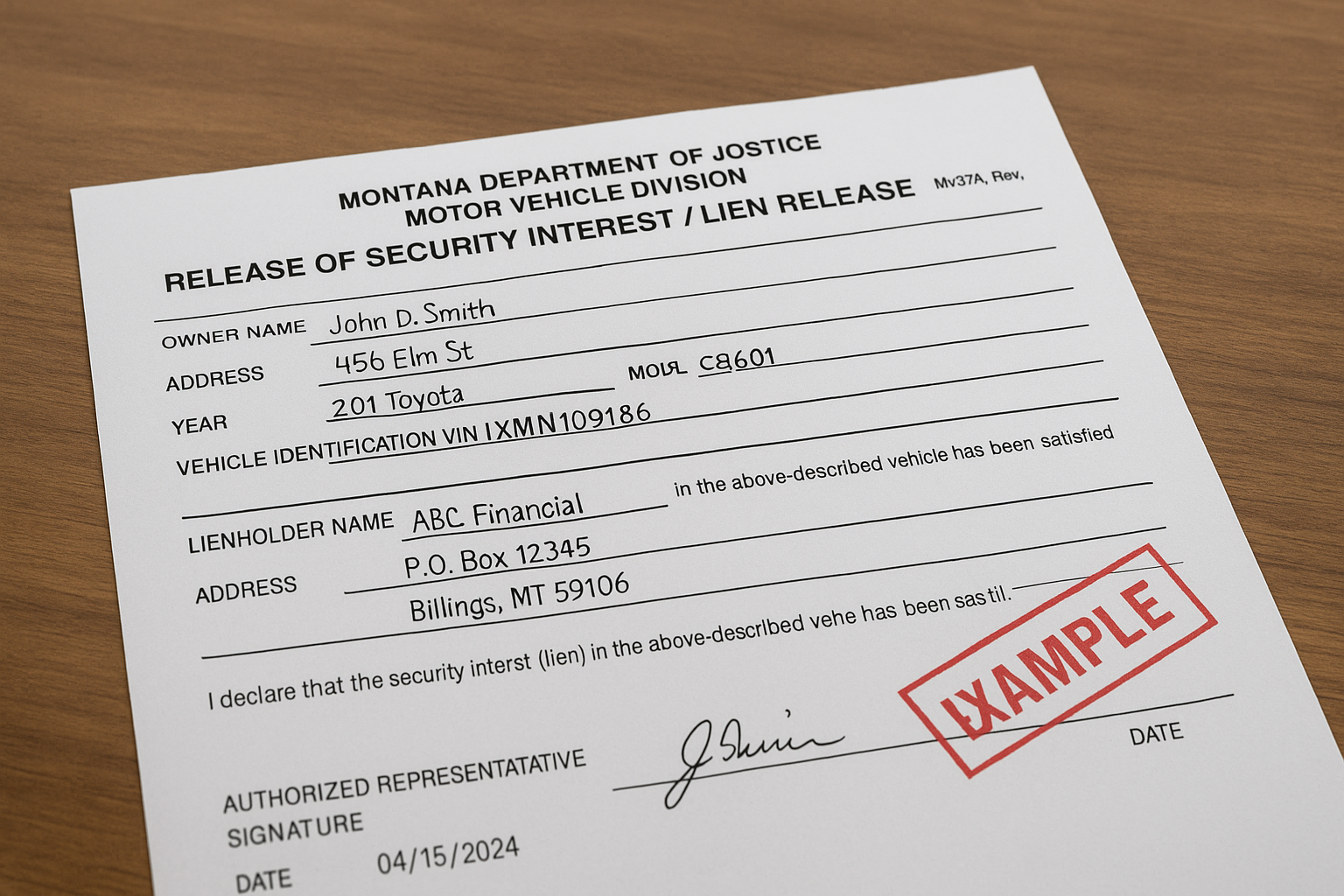

Car Title Before and After Lien Removal – Illustration Only (Example Comparison)

State-by-State Lien Release Information

Each state handles lien releases differently. Here is what to expect in key states.

| State | Key Details |

| California | 21 days to release after payoff. Title fee $23. Contact: California DMV or call 1-800-777-0133. |

| Texas | 10 days to release after payoff. Title fee $28–$33. Contact: Texas DMV. |

| Georgia | 5 days to release after payoff. Title fee $18. Liens expire after 10 years per Georgia Title Code § 40-3-56. Contact: Georgia DOR. |

Good to Know: In Georgia and most other states, liens expire automatically after 10 years. This is outlined in Georgia Code § 40-3-56. If your lien is that old, ask your DMV whether they can remove it based on age alone.

What to Do If the Lienholder Is Out of Business

This is more common than you might think. Banks fail, dealerships close, and finance companies get bought out. Here are your options for getting a lien release when you cannot reach the original lender.

Step 1: Check the FDIC Failed Bank List

Best if the lender was a bank. Visit the FDIC Failed Bank List to see if your lender is listed. If so, you can request a lien release directly from the FDIC or contact the bank that acquired the accounts.

Step 2: Search Secretary of State Records

Best if the lender changed names or merged. Go to your state’s Secretary of State business search and look up the company name. You may find they simply changed names or transferred customers to another lender.

Step 3: Contact the Acquiring Company

Best if another company took over the accounts. Once you identify who acquired your lender, contact them with your loan details and request a lien release letter.

Step 4: File for a Court-Ordered Title

Last resort when all else fails. If you cannot locate anyone who can release the lien, you can petition the court to declare you the legal owner.

This process ensures that debts and claims are addressed and that ownership rights are properly enforced. It can take time and may require an attorney, but it is an option when nothing else works.

Frequently Asked Questions About Removing a Lien

Can I Remove a Lien Without Visiting the DMV?

Yes, in many cases. If your lender uses electronic lien release, the DMV sends you a clean title automatically and you do not need to do anything. Check with your lender to confirm they participate in ELT.

What If I Lost My Lien Release Letter?

Contact your lender and request a duplicate. If the lender has closed, follow the options above to track down whoever took over their accounts.

Do I Need a Lien Release to Sell My Car?

Yes. To sell your car, the lien must be released so you can transfer a clear title to the buyer.

You can sell a car that still has a lien, but you must tell the buyer upfront and make sure the lien is paid off as part of the sale. This protects both you and the buyer and helps you avoid legal issues.

In most states, selling a car without disclosing a lien is a civil issue. However, some states, like Texas, treat it more seriously and you could face criminal charges for hiding the lien.

What If an Old Lien Still Shows Up on My Title?

Contact your original lender or their successor for a lien release letter. If the lien is over 10 years old, your DMV may remove it based on age alone.

How Long Does the Lender Have to Release the Lien After Payoff?

By law, lenders must release your lien within 3 to 10 business days after you pay off the loan, depending on your state. If two weeks pass without any update, contact them directly.

Bottom Line

Removing a lien from your car title is usually a simple process. Most lenders release liens electronically through ELT, which means you receive a clean title in the mail without doing anything.

If that does not happen, request a lien release letter from your lender and bring it to your DMV. The whole process takes anywhere from a few days to a few weeks.

Once you have a clean title, you are free to sell, trade, or refinance your vehicle with no restrictions. For more about how liens work and affect your ownership, see our guide on what a lien on a car title means.

Related Resources