Whether you’re buying or selling a used car, confirming a loan payoff, or trying to avoid lien scams, this guide shows you how to check for liens quickly and for free.

A lien is a legal claim on a vehicle that allows a lender to repossess it if the loan isn’t paid.

Key Takeaways

- You can check for a lien for free by looking at the physical title, calling your state DMV, or using NMVTIS approved tools like VinCheck.info.

- The VIN (Vehicle Identification Number) is all you need to run a lien check and see if a car has a lien or not.

- If you find a lien, the seller must pay it off before they can legally transfer the title to you.

- Paid services like CARFAX ($39.99), VinAudit ($9.99), and VINsmart ($9.99) provide detailed vehicle history beyond just lien status.

- Always verify lien status before you hand over any money. Buying a car with an active lien means you could lose the car.

- Each state has different rules. California, Texas, Florida, and Georgia each have specific DMV processes covered in this guide.

Why You Must Check for Liens

Buying a used car without checking for liens is like buying a house without checking the deed.

A lien on a car title is a legal claim that gives a lender the right to take the vehicle if the loan isn’t paid. If you buy a car with an active lien, you could lose your money and the car.

The good news? Checking for liens takes just a few minutes. This guide shows you how to do it for free, plus when paid services are worth the money.

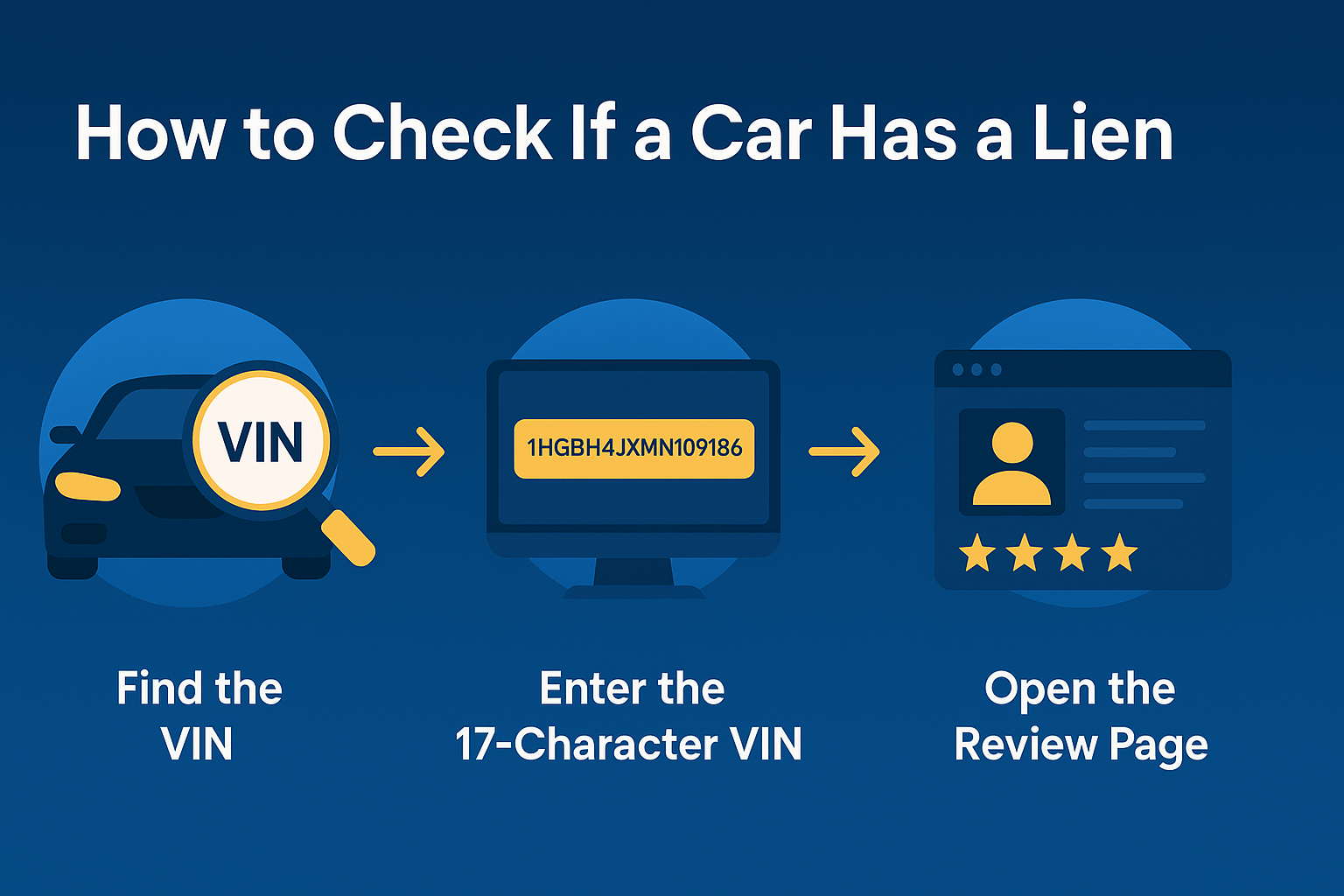

What You Need to Check for a Lien

Before you start, gather this information:

- VIN (Vehicle Identification Number): A 17-character code found on the dashboard (driver’s side), the door jamb sticker, or registration documents. This is the most important piece of information.

- License plate number: A few states, including Florida, allow license plate searches through their DMV systems. However, most states require the VIN for lien checks.

- Physical title (if available): Ask the seller to show you the actual title document. If they can’t produce it, that’s a red flag.

Important: Always verify the VIN on the actual vehicle matches the paperwork. Scammers sometimes use VINs from different cars.

Free Ways to Check for a Car Lien

You don’t need to pay anything to find out if a car has a lien. Here are the best free methods:

Check the Physical Title Document

Quickest option. Ask the seller to show you the car’s title. Look for these sections:

- Lienholder section: Look for a box labeled “Lienholder” or “Legal Owner.” If a bank name appears here, there’s an active lien.

- Lien release stamp: If the lien was paid off, you should see a “Lien Satisfied” stamp with a date.

- Title type: A “clean” title has no active liens. A “lien title” shows an outstanding debt.

Watch out: Sellers can request duplicate titles that may not show recent liens.

How to protect yourself: After checking the physical title, run a second verification through your state’s DMV website or an online NMVTIS check.

Contact Your State DMV

Most accurate source. Your state’s DMV keeps official records of all liens. Here’s how to check:

- Online: Many states offer free online title status checks. Visit your state’s DMV website and look for “title search” or “lien check.”

- By phone: Call your local DMV office with the VIN. They can tell you if a lienholder is recorded.

- In person: Visit your local DMV office with the VIN. Fees vary by state, ranging from free to $20.

Tip: DMV records are the most accurate source for lien information. Online services sometimes have delays in reporting lien releases.

Use NMVTIS (National Motor Vehicle Title Information System)

Best for comprehensive checks. The NMVTIS is a federal database managed by the Department of Justice. It collects title and brand information from all 50 states.

While the database itself isn’t free to access directly, some approved providers offer free or low-cost reports.

Free NMVTIS-Based Options:

- VinCheck.info provides free basic vehicle history reports using NMVTIS data, including title brands and basic lien information.

- NICB VinCheck is free and checks for theft records. Useful for detecting stolen vehicles and fraud.

Note: NMVTIS shows title brands (salvage, flood, junk) and odometer readings. Lien data varies because not all lenders report. For current lien status, verify with the DMV.

Request Documentation from the Seller

Best for private sales. A legitimate seller should be able to provide:

- Lien release letter: An official document from the lender stating the loan is paid in full.

- Payoff statement: If there’s still a balance, this shows exactly how much is owed.

- Contact information for the lender: So you can verify the lien status directly.

Red flag: If a seller refuses to provide documentation or gets defensive about lien questions, walk away.

Paid Lien Check Services

Paid services provide more comprehensive vehicle history reports, including accident history, odometer readings, and ownership records.

According to Kelley Blue Book and NerdWallet, services like CARFAX or AutoCheck provide detailed vehicle-history reports for $25-$45.

| Service | Price | What You Get |

| CARFAX | $39.99 | Lien status, accident history, service records, ownership, odometer. Most comprehensive. |

| VinAudit | $9.99 | NMVTIS-approved. Lien/impound, title history, theft, salvage. Great value. |

| VINsmart | $9.99 | NMVTIS-approved. Lien & lease check, title concerns, vehicle valuations. |

| AutoCheck | $24.99 | Experian-powered. Accident history, title problems, odometer check. |

| State DMV | $0-$10 | Official lien status only. Most accurate for current liens. |

What Experts Say:

The Federal Trade Commission (FTC) recommends getting a vehicle history report before buying a used car.

“Vehicle history reports can tell you a lot about a used car. A report might include ownership history, whether the car was in any accidents, and its repair records.”

Good to Know:

For inexpensive vehicles, a free DMV check may be sufficient. For expensive purchases, spending $10-$40 on a report can save thousands.

How to Read Your Lien Check Results

Got your lien check results?

The results will show the current status of any claims against the vehicle. Here is what different outcomes mean:

- “Clear” or “Clean” title: Great news! No active liens. You’re good to go! The seller can legally sell the vehicle.

- “Lienholder listed” or “Active lien”: Hold off on buying. Someone has a legal claim on the car. See the next section for options.

- “Lien released” or “Satisfied”: Good sign, but verify. Get official documentation confirming the release.

- “Electronic lien” or “ELT”: Don’t worry. The lien is recorded electronically through an ELT system. This is standard practice.

What to Do If You Find a Lien?

Finding a lien doesn’t mean you can’t buy the car. It just means you need extra steps to protect yourself.

Option 1: Have the Seller Pay It Off First

The safest approach. Ask the seller to pay off the lien before you complete the purchase.

They’ll receive a lien release from the lender, which they can file with the DMV to get a clean title. Only then should you hand over money.

Option 2: Pay the Lienholder Directly

Best when seller lacks funds. If the seller can’t pay off the lien without your money, pay the lienholder directly.

Contact the lender, get the exact payoff amount, and pay them. The lender will release the title. Never give money to the seller to “pay off the loan.”

Option 3: Use an Escrow Service

Most secure for high-value purchases. Use a reliable escrow service like Escrow.com or KeySavvy that holds your payment until the lien is released.

This adds a small fee but eliminates risk entirely.

For step-by-step instructions, see our guide on how to remove a lien from a car title.

How to Check for Liens in Your State

The most accurate way to check lien status is through your state’s official DMV website.

Each state has different processes. Here’s how to do it in four of the most populous states:

California

California uses an Electronic Lien and Title (ELT) system for most liens. The state does not offer a free public lien check tool.

- Online: No free public lien check available. Use a paid NMVTIS provider.

- By phone: Call 1-800-777-0133 with the VIN.

- Title fee: $23 for a standard title. Rush processing available for an additional fee.

For official information, visit the California DMV website.

Texas

In Texas, lienholders hold the title until the loan is paid off. They must release it within 10 days of final payment.

- Online: Use the free Texas DMV’s title check tool to check for title brands.

- In person: Visit your county tax assessor-collector’s office with the VIN.

- Title fee: $5.45 for a certified copy of the title.

For official information, visit the Texas DMV website.

Georgia

Georgia provides online tools for checking vehicle title status through its DRIVES e-Services system.

- Online: Use Georgia’s DRIVES e-Services to check title status with the VIN.

- In person: Visit your county tag office with the VIN.

- Lien filing fee: $18 to record a security interest on a title.

For official information, visit the Georgia DOR Motor Vehicles page.

Florida

Florida

Florida offers free online access to basic vehicle title information, including lien status.

- Online: Use Florida’s free Motor Vehicle Check tool to view title and lienholder information.

- By phone: Call 850-617-2000 with the VIN.

- Title fee: $70 for an original or duplicate title.

For official information, visit Florida’s DHSMV website.

Good to Know

- Timing matters: Check as close to your purchase date as possible. A check done weeks ago may be outdated.

- Out-of-state vehicles: Liens from another state may not appear in your state’s records. Use NMVTIS.

- Dealer purchases are safer: Dealers typically clear all liens before selling. Private sales carry more risk.

- Multiple liens are possible: Make sure all liens are cleared, not just the primary one.

- Mechanic’s liens exist: Unpaid repair bills can create liens too. These are harder to find.

Frequently Asked Questions

How Long Does It Take to Check for a Lien?

Online checks take about 2-5 minutes if you have the VIN ready.

Phone or in-person DMV checks may take 10-30 minutes depending on wait times. Paid reports are instant.

Can I Check for a Lien Without the VIN?

Some states and third-party services allow searches by license plate, though availability varies.

The VIN is always more reliable because it’s unique and doesn’t change when plates are swapped. If the seller won’t provide the VIN, that’s a warning sign.

Do Liens Show Up on All Vehicle History Reports?

Not always. CARFAX notes when a lien is reported but may not show when it’s released.

DMV records are more accurate for current status. Use both for the complete picture.

What If the Lien Is from a Bank That Closed?

Banks that close are usually acquired by other institutions. Your state DMV maintains records of bank mergers.

You can also search the FDIC’s BankFind Suite to find which institution took over the original bank.

Can I Still Get a Loan on a Car That Has a Lien?

Yes, but the existing lien must be paid off first.

If you’re financing your purchase, your new lender will require the old lien to be cleared as part of the process.

If you already own a car with a lien and need financing, see our guide on getting a title loan with an existing lien.

How Do I Know If a Lien Release Is Legitimate?

A vehicle lien release is legitimate if the lien no longer appears in the official DMV or NMVTIS record for that VIN.

After receiving the lien release document, check the VIN through NMVTIS to confirm the lien is removed.

Bottom Line

Whether you’re buying or selling a used car, confirming a loan payoff, or avoiding scams, you should always check for liens.

It only takes a few minutes, and it can save you thousands of dollars and countless headaches.

Start with a free method: look at the title, call the DMV, or use a free NMVTIS tool. For expensive purchases, invest in a paid vehicle history report.

Remember: a lien means someone else has a legal claim on that car. Never hand over money until you’re certain the title is clear.

For more about liens, see our complete guide on what a lien on a car title means.

Have Questions About Car Liens or Title Loans?

If you own a car and need cash, Montana Capital Car Title Loans may be able to help.

We can check your eligibility for free, regardless of whether your car has a lien. We even offer title loans for cars with existing liens in many cases.

- Call us or Check eligibility online

Related Resources

- What Does a Lien on a Car Title Mean? – Complete guide to car liens

- How to Remove a Lien from a Car Title – Step-by-step lien removal

- How to Sell a Car with a Lien – Selling when you owe money

- Can You Get a Title Loan with an Existing Lien? – Financing with a lien

Disclaimer: Montana Capital Car Title Loans is a licensed lender. This information is for educational purposes and not legal or financial advice. State DMV procedures change frequently. Please verify requirements with your state’s official DMV website. Loan approval depends on ability to repay.